Financial Compatibility: The Key to a Thriving Relationship

Estimated Reading Time: 7 Minutes

"A successful marriage requires falling in love many times, always with the same person." – Mignon McLaughlin.

This heartfelt quote perfectly captures the essence of nurturing relationships. While love is essential, another vital component is ensuring your financial philosophies align. In today's world, financial compatibility is just as crucial as emotional compatibility for a thriving relationship. This blog post explores why financial compatibility is essential for couples and provides strategies to achieve it.

Understanding Financial Compatibility

What is Financial Compatibility?

Financial compatibility refers to how well partners align on their values, attitudes, and behaviors around money. This includes:

- Spending Habits: Are both partners savers, spenders, or somewhere in between?

- Attitudes Toward Debt: What are your comfort levels with loans, credit cards, and mortgages?

- Financial Goals: Do you have shared visions for the future, like buying a home or saving for retirement?

- Risk Tolerance: Are you willing to invest or engage in other financial ventures?

Understanding financial compatibility goes beyond just having similar incomes. It means diving deep into how you manage money together. When partners have compatible financial perspectives, they can navigate money management with much less conflict and greater cooperation. Conversely, differing views can lead to stress and strain.

For more insights on financial compatibility, you can explore this source: Blissful Ties and Psychology Today. Additionally, discussing financial matters is one of the Essential Premarital Discussion Topics for building a strong and lasting marriage.

Signs of Financial Incompatibility

Certain indicators can signal financial incompatibility, such as:

- Hiding purchases or financial information from each other.

- Discomfort discussing income differences.

- Frequent arguments about budgeting or long-term financial planning.

These warning signs suggest that there are underlying issues related to financial communication. Addressing such differences can prevent bigger conflicts from arising later.

To learn more about the challenges of financial incompatibility, refer to Dr. Audrey T and Blissful Ties.

Importance of Money in Relationships

Financial Disputes and Their Effects

Money frequently ranks among the top reasons couples argue and even separate. In fact, financial disputes are one of the leading causes of breakups and divorces worldwide. Not only do these arguments lead to tension, but they can also affect emotional well-being and intimacy. Consider how financial stress can undermine your relationship—anxieties over bills or debts can hinder collaboration on other life goals.

For more details on the impact of finances on relationships, check out Blissful Ties and the Guide to a Happy Married Life for Newly Married Couples.

Differing Money Ideologies

Imagine a partner who loves to save for the future paired with another who prefers to spend on present experiences. Clashing beliefs about debt can also cause friction: one may be comfortable using credit cards while the other avoids debt entirely. Such conflicts, if left unresolved, can lead to chronic resentment over time.

Understanding these dynamics is critical to maintaining healthy discussions about finances. If you’d like to dive deeper, visit Psychology Today and consider insights from Arranged or Love Marriage: A Comprehensive Guide to understand different perspectives within marriages.

Assessing Your Financial System as a Couple

Why Assessment Matters

To foster a harmonious financial relationship, partners should spend time understanding each other's financial habits and views. This can prevent future conflicts and promote healthier financial collaboration.

A Comprehensive Checklist

Here’s a checklist of questions to evaluate your financial compatibility together:

- Do we prefer saving for future security or spending on current experiences?

- How do we feel about taking on debt for purchases?

- Are we comfortable investing in stocks or starting a business?

- Is financial transparency important in our relationship?

- Do we share similar aspirations, such as homeownership or early retirement?

- How do we handle major financial decisions—individually or collaboratively?

By answering these questions and having open conversations, couples can identify potential friction points. Connecting on these topics not only fosters better understanding but also builds a stronger relationship. For additional resources, refer to Dr. Audrey T, Blissful Ties, and the Essential Premarital Discussion Topics.

Aligning Financial Goals Before Marriage

The Importance of Pre-Marital Financial Planning

Discussing money before marriage is crucial for establishing a shared financial future to prevent misunderstandings. By addressing financial compatibility early on, couples can lay a stronger foundation for their relationship.

Managing Finances Together

Couples can choose from several approaches to managing their finances:

- Combining Finances: Merging accounts and sharing all financial responsibilities. (Pros: Easier tracking. Cons: Less individual control.)

- Maintaining Separate Accounts: Keeping individual accounts while sharing expenses. (Pros: Individual freedom. Cons: Possible communication delays.)

- Hybrid Approach: Combining some aspects while keeping other finances separate. (Pros: Best of both worlds. Cons: Requires careful management.)

Encouraging couples to choose a system that works best for their dynamic helps create a solid foundation. Refer to the Guide to a Happy Married Life for Newly Married Couples for more strategies on managing finances together.

Setting Financial Goals

Joint Goals: Such as buying a home, planning for children, or saving for retirement.

Individual Goals: Such as hobbies, education, or personal investments.

Balancing both types of goals helps you maintain autonomy while supporting shared aspirations. For further insights, check Blissful Ties and Arranged or Love Marriage: A Comprehensive Guide.

Practical Tips for Financial Planning

- Creating a Shared Budget: Detail both partners’ incomes and expenses.

- Open Communication: Regularly discuss financial matters in a judgment-free environment.

- Reassessing Plans: Life circumstances change, so remaining flexible is essential.

Strategies for Enhancing Financial Compatibility

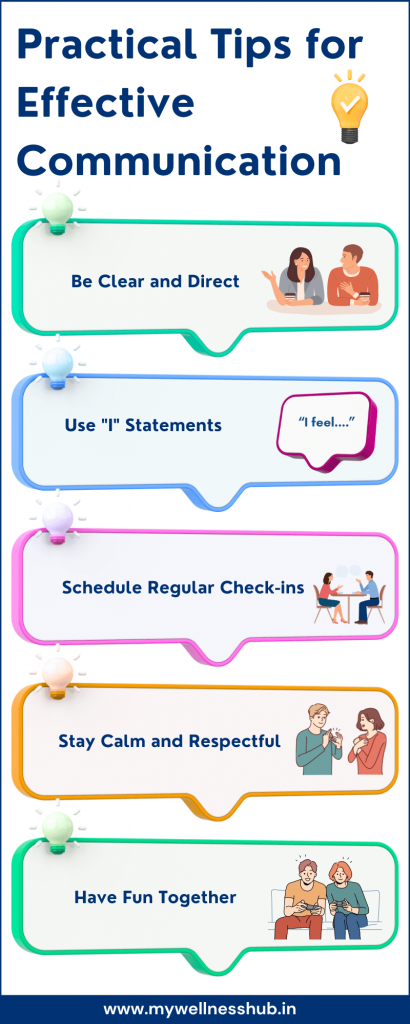

Regular Financial Check-ins

Regularly scheduled money talks are essential. Set aside time to discuss your financial goals, updates, and any arising concerns. This practice prevents misunderstandings, discusses successes, and addresses potential conflicts proactively.

Developing a Joint Financial Vision

Creating shared milestones can strengthen your commitment to achieving financial goals together. Consider making vision boards that depict your aspirations, such as homeownership, travel, or retirement plans.

Seeking Professional Guidance

Consulting financial advisors can offer personalized strategies, while educational workshops can enhance your collective financial literacy. This collaborative approach can benefit both partners and contribute to a healthier financial partnership. For more inspiration, check out Blissful Ties and the Guide to a Happy Married Life for Newly Married Couples.

Navigating Financial Challenges Together

Effective Communication Techniques

Healthy communication is key to resolving conflicts:

- Active Listening: Pay attention to your partner's perspective without interruption.

- Utilizing "I" Statements: Focus on personal experiences rather than making accusations.

- Avoiding Judgment: Keep respect front-of-mind even during disagreements.

Creating an environment where both partners feel heard can significantly decrease tension over financial topics. For more tips on financial communication, see Blissful Ties and the Essential Premarital Discussion Topics.

Understanding Financial Histories

Recognizing how each partner's upbringing influences their financial behaviors is vital. Discussing past experiences with money fosters empathy and strengthens connections.

Compromise and Collaboration

Couples should actively seek common ground, even when their views differ. Adjust personal expectations for mutual benefit, approaching financial challenges as a united front.

Conclusion

Recapping the importance of financial compatibility reveals its crucial role in nurturing a healthy relationship. It affects daily harmony and the achievement of long-term dreams. Proactively discussing and managing finances fosters trust, teamwork, and lasting happiness. For more insights, explore the thoughts shared in Blissful Ties, Psychology Today, and the Essential Premarital Discussion Topics.

Final Thought

“By aligning your financial goals, you're not just investing in your future wealth but also in the wealth of your relationship.”

Call to Action

Share your own experiences—have you navigated financial compatibility challenges in your relationship? What strategies have worked for you? Join the conversation in the comments below!

Also, don’t forget to subscribe for more insights on nurturing both your relationship and financial well-being. Sharing this post with friends or on social media can help raise awareness about the importance of financial compatibility in relationships.

Relationships Finance Marriage-

What to include in my Wedding Website

What to include in my Wedding WebsiteDream Wedds

-

-

-

How Engagement Party should be celebrated

How Engagement Party should be celebratedLeonard Bernstein

-

Elevate Your Haldi and Mehandi Ceremony Glam

Elevate Your Haldi and Mehandi Ceremony GlamNeeraj Singh

-

-

-

-

-

-

-

-

-

-

YOUR BIO AND HOW WE MET

YOUR BIO AND HOW WE METLeonard Bernstein

-

The Ultimate Wedding Planning Checklist for Indian Weddings

The Ultimate Wedding Planning Checklist for Indian WeddingsSimranpreet Singh

-

-

A Guide to Health, Wellness post Marriage

A Guide to Health, Wellness post MarriageSaujanya Bose

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Personal Space: The Key to a Healthy and Balanced Marriage

Personal Space: The Key to a Healthy and Balanced MarriageDreamWedds Team

-

-

Fade Dark Spots: Natural Remedies and Tips for Clearer Skin

Fade Dark Spots: Natural Remedies and Tips for Clearer SkinDreamWedds Team

-

-

Selecting the Perfect Foundation Shade: Your Ultimate Guide

Selecting the Perfect Foundation Shade: Your Ultimate GuideDreamWedds Team

-

-

-

-

-

Health and Wellness for Brides and Grooms

Health and Wellness for Brides and GroomsDreamWedds

-

-

-

-

-

-

-

The Ultimate Guide to Achieving Long-Lasting Bridal Makeup

The Ultimate Guide to Achieving Long-Lasting Bridal MakeupDreamWedds Team

-

-

-

:max_bytes(150000):strip_icc()/Kitzcornermedium-c9abd848ea634040a06bb6db8b8a7304.jpg)

-

-

-

-

-

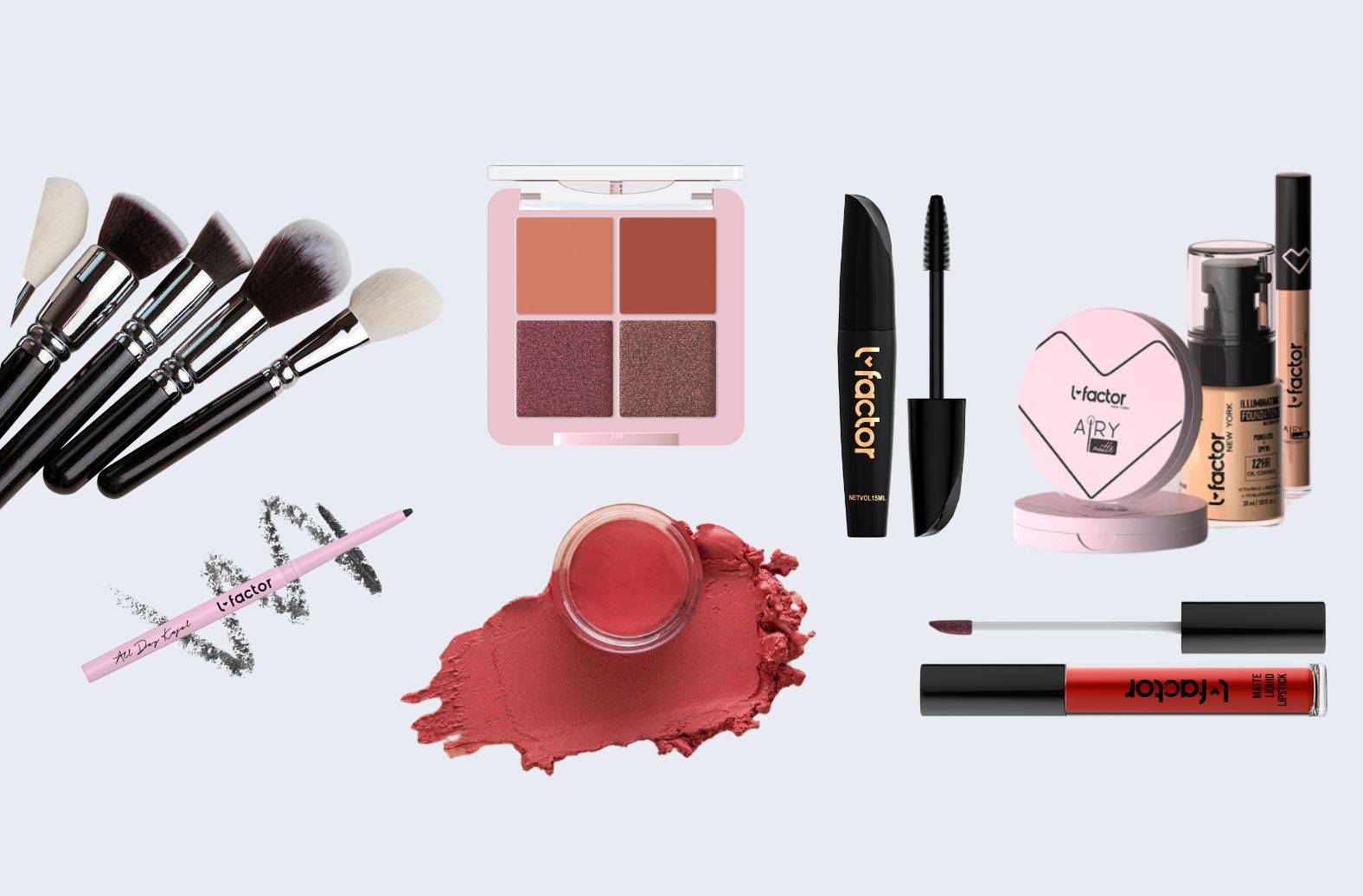

Makeup Basics: Essential Cosmetics Every Beginner Should Own

Makeup Basics: Essential Cosmetics Every Beginner Should OwnDreamWedds Team

-

-

-

-

-

-

-

-

-

Virat & Anushka: A Fairytale Wedding to Remember!

Virat & Anushka: A Fairytale Wedding to Remember!Yashashvi Mathur

-

-

-

-

The Importance of a Bridal Makeup Trial for Your Wedding Day

The Importance of a Bridal Makeup Trial for Your Wedding DayDreamWedds Team

-

-

-

Effective Natural Skincare Remedies to Reduce Pore Size

Effective Natural Skincare Remedies to Reduce Pore SizeDreamWedds Team